With this application, customers have payment flexibility, and businesses can make present decisions to positively affect growth. Under periodic inventory procedure, a merchandising company uses the Purchases account to record the cost of merchandise bought for resale during the current accounting period. The Purchases account, which is increased by debits, appears with the income statement accounts in the chart of accounts. Similar to purchase returns and discounts, company has to record them into the accounting system. The record will impact the accounts receivable and net off with sale revenue. The journal entry is debiting sale discount/sale return and credit accounts receivable.

- They can quickly count the goods they are working with, whereas a perpetual system, which provides a more accurate inventory, requires training staff on electronic scanners and data entry.

- At the end of the period, a perpetual inventory system will have the Merchandise Inventory account up-to-date; the only thing left to do is to compare a physical count of inventory to what is on the books.

- The guide has everything you need to understand and use a periodic inventory system.

- However, there is no way to consider these unforeseen changes with the periodic inventory.

Adjusting and Closing Entries Under the Periodic Inventory Method

It’s a straightforward way to manage inventory, but it also means stock numbers are only accurate right after the count is completed. Occasionally businesses will take a physical inventory count to determine if it actually has all items it thinks it has per its accounting records. Inventory shrinkage is the difference that results when the amount of actual inventoryphysically counted is less than the amount of inventory listed in the accounting records. So, every time a product is purchased or sold, the perpetual system uses a barcode scanner to update the inventory count, and recalculate the corresponding cost of goods sold.

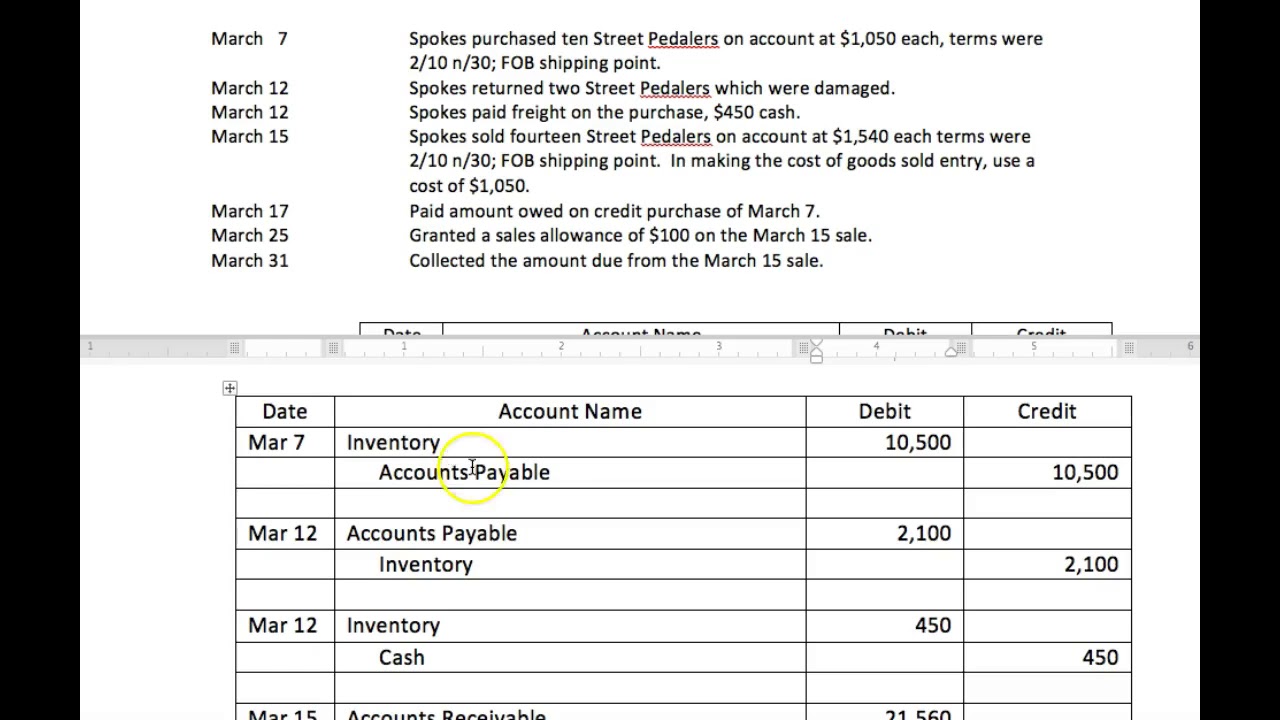

Which Companies Use The System?

The physical inventory count is the process in which staff use a predetermined method to count the goods. Such a method is usually scheduled at the end of a reporting period, often on a weekly or monthly basis. This allows the company to have an accurate count of their stock in order to plan for future orders and to ensure that their records are always up-to-date. Note that this adjusting entry adjusts the merchandise inventory account to its proper ending balance in order to zero out the purchases account and create a cost of goods sold account. Its journal entries for the acquisition of the Model XY-7 bicycle are as follows. The overall cost of the inventory item is not readily available and the quantity (except by visual inspection) is unknown.

What is a periodic method?

In a periodic inventory system, you update the inventory balance once a period. You can assume that both the sales and the purchases are on credit and that you are using the gross profit to record discounts. Regularly assessing stock levels and maintaining accurate records can be facilitated by a periodic inventory system.

What is Physical Stock? Meaning, Types, Steps & Best Practices of Physical Inventory Counting Methods in 2023

Under a periodic review inventory system, the accounting practices are different than with a perpetual review system. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock. Organisations use estimates for mid-year markers, such as monthly and quarterly reports. Accountants do not update the general ledger account inventory when their company purchases goods to be resold. The accountant removes the balance to another account at the end of the year.

Setting up a periodic inventory system is an essential part of maintaining accurate stock records. It involves establishing a system that routinely checks the stock levels of inventory and keeps track of any discrepancies between the actual stock records and the recorded inventory. Physical inventory counts also help internal revenue service 2021 to identify any discrepancies between the physical and the recorded stock levels. This helps in ensuring that the stock levels are accurate and that any discrepancies can be rectified. When the stock is counted, the periodic inventory system is used to compare the physical count to the amount that was in the records.

To maintain consistency, we’ll use the same example from FIFO and LIFO above to the calculate weighted average. In this example, the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. Record the purchase returns by debiting the accounts payable or accounts receivable account and crediting the purchase returns account. Record the purchase of inventory in a journal entry by debiting the purchase account and crediting accounts payable. You can use them to get paper inventory lists, import the stock data and calculate the data you need to order more stock and reconcile the stock you have for a new period. A company will choose the software based on its needs and the requirements of its products.

The total of the beginning inventory and purchases during the period represents all the firm’s goods available for sale. “Dollar stores,” which have become particularly prevalent in recent years, sell large quantities of low-priced merchandise. Goods tend to be added to a store’s inventory as they become available rather than based on any type of managed inventory strategy. Again, officials must decide whether keeping up with the inventory on hand will impact their decision making. Visual inspection can alert the employees as to the quantity of inventory on hand. Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold will close with the temporary debit balance accounts to Income Summary.

After subtracting the ending inventory from this total, the remaining balance represents the cost of the items sold. However, the sheer volume of transactions in some merchandising businesses makes it impossible to use anything but the periodic system. Learn more about how you can manage inventory automatically, reduce handling costs and increase cash flow. They report the ending inventory for each purchase date first, then add them up.