Merchandising businesses that deal with hundreds of transactions a day, such as grocery stores or pharmacies, can’t possibly maintain their inventory through a periodic inventory system. We are physically counting inventory only at the end of the period and reconciling that with the inventory recorded in the books. But task can become tedious ad complicated if the quantity of inventory is very high and it also involves may types of the same. There is also the possibility of error while counting, misplacement or theft leading to inaccuracy. Although this method requires one less entry, the cost of goods sold is not specifically determined. Determining the cost of the ending inventory and the cost of goods sold helps determine the periodic income and financial position.

- A perpetual inventory system automatically updates and records the inventory account every time a sale, or purchase of inventory, occurs.

- However, the need for frequent physical counts of inventory can suspend business operations each time this is done.

- Small inventory levels and limited stock won’t take more than a couple of hours to count, and the cost of goods sold can be estimated through very few simple calculations.

- A business can easily create purchase orders, develop reports for cost of goods sold, manage inventory stock, and update discounts, returns, and allowances.

Less Control and Information

Calculate COGs for each line item, and then add them together to get the period’s COGS. When a buyer receives a reduction in the price of goods shipped but does not return the merchandise, a purchase allowance results. We hope our guide was helpful in understanding the basics of the periodic inventory system. Then, a second closing entry is to reduce the balance of the COGS account, by the year-end inventory still on hand. Because there’s no constant inventory tracking, it can be difficult for a firm to be aware of which goods are running low on stock, or if there’s an excess supply for a type of inventory. Through a perpetual system, businesses are also able to access inventory reports at all times, and reduce human error through automation.

What is the formula for closing entries under the periodic inventory method?

Then, whenever inventory levels hit a reorder point, the software automatically generates the purchase orders necessary for restocking. The concerned department continuously keeps track of the raw materials, the work in progress and the level of finished goods, all three of them being a part of inventory tracking system. Under a periodic inventory system the goods are physically counted, without automatic use of any software of automated counting system. However, during the counting process, the accurate aand updated information of the inventory level will not be present. The transaction will reduce the purchase which is the inventory account and it will decrease the accounts payable as the supplier has agreed.

Advantages and Disadvantages of the Perpetual Inventory System

A firm finally uses the account to determine final inventory carrying costs. A periodic inventory system updates and records the inventory account at certain, scheduled times at the end of an operating cycle. The update and recognition could occur at the end of the month, quarter, and year. There is a gap between the sale or purchase of inventory and when the inventory activity is recognized.

The Merchandise Inventory account balance is reported on the balance sheet while the Purchases account is reported on the Income Statement when using the periodic inventory method. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method. A periodic inventory system is a type of inventory control system that relies on physical inventory counts at predetermined intervals to track inventory levels and values. This method is often used by small businesses and those with low-volume sales as it is easier and more cost-effective to implement than a perpetual inventory system.

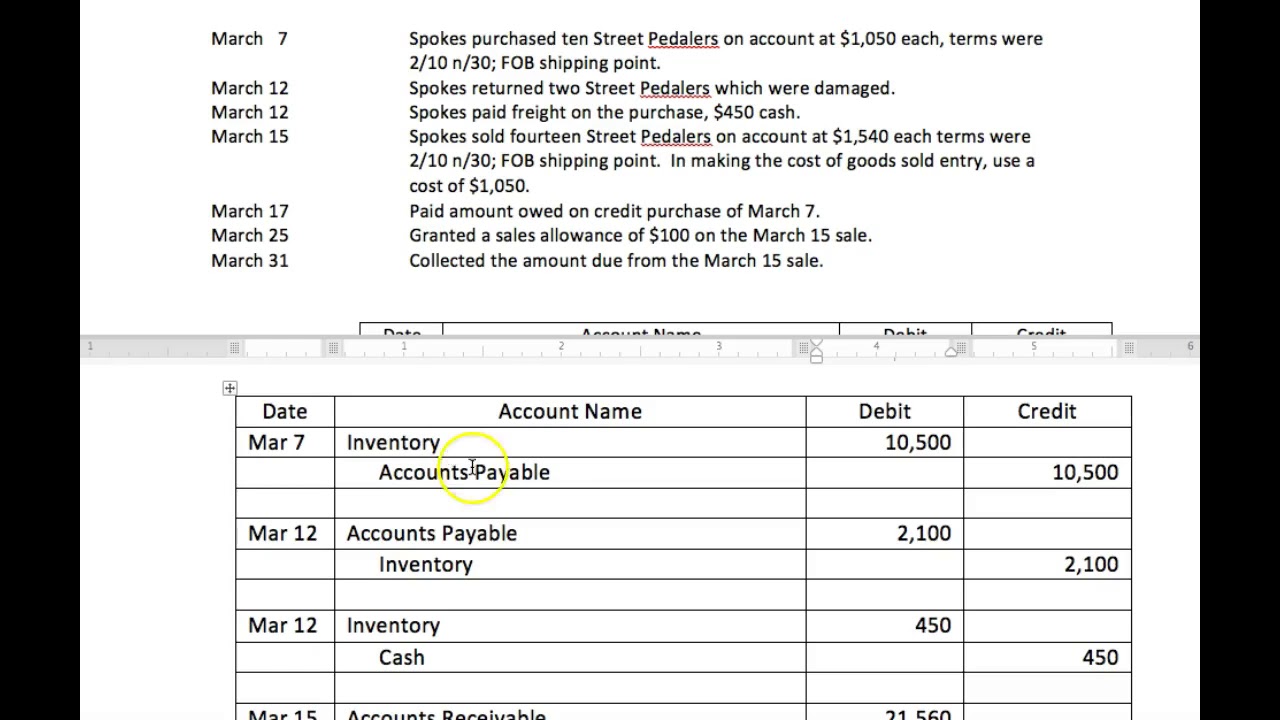

Accounting Under the Periodic Inventory System: Journal Entries

Separate subsidiary ledger accounts show the balance for each type of inventory so that company officials can know the size, cost, and composition of the merchandise. A periodic system is cheaper to operate because no attempt is made to monitor inventory balances (in total or individually) until financial statements are to be prepared. A periodic system does allow a company to control costs by keeping track of the individual inventory costs as they are incurred. The biggest disadvantages of using the perpetual inventory systems arise from the resource constraints for cost and time. This may prohibit smaller or less established companies from investing in the required technologies.

On May 21, shipping terms were FOB Shipping Point meaning we, as the buyer, must pay for shipping. Under the periodic inventory system, we will debit Transportation (or freight) In for the shipping cost and credit cash or accounts payable depending on if we paid it now or later. To illustrate the periodic inventory method journal entries, assume that Hanlon Food Store made two purchases of merchandise from Smith Company. Since 2016, Qoblex has been the trusted online platform for small and medium-sized enterprises (SMEs), offering tailored solutions to simplify the operational challenges of growing businesses. With a diverse global team, Qoblex serves a customer base in over 40 countries, making it a reliable partner for businesses worldwide.

Simple counts on legal paper can suffice for collecting product data, especially if you only offer a few goods. A basic count during the day or week is often enough for a small business to get an adequate handle on their inventory. This means there is no need for expensive or complicated equipment, just essential information collection tools – pen and paper. With the periodic inventory method, the ending inventory from your previous physical count becomes the beginning inventory for the next period. For instance, if a retail company doesn’t have the right amount of inventory to meet customer demands, it will lose sales. Production might have to stop for a few hours or days, and the company will lose money because it still has to pay its employees, rent, and more.

Not only must an adjustment to Merchandise Inventory occur at the end of a period, but closure of temporary merchandising accounts to prepare them for the next period is required. Temporary accounts requiring closure are Sales, Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold. Sales will close with the temporary credit balance accounts to Income Summary. Using the purchase transaction from May 4 and no returns, Hanlon pays the amount owed on May 10. When merchandise is purchased, the cost is not debited to the Inventory account, but rather to another account called Purchases. Under a periodic inventory system, any change in inventory is recorded periodically, typically at the end of the month or year.

This is in contrast to the perpetual inventory method, another inventory management system that has become popular due to advances in technology. This inventory valuation method is possible through point-of-sale (POS) systems and radio frequency identification tags tied directly to accounting software packages. The perpetual inventory method automatically and continuously records purchases and sales as they happen and updates the inventory account.

Usually, the physical count takes place immediately before the preparation of financial statements. This method is most effective for a company with a small amount of inventory due to the labor required to do a physical count of inventory. Companies using periodic inventory turbotax discount procedure make no entries to the Merchandise Inventory account nor do they maintain unit records during the accounting period. Thus, these companies have no up-to-date balance against which to compare the physical inventory count at the end of the period.